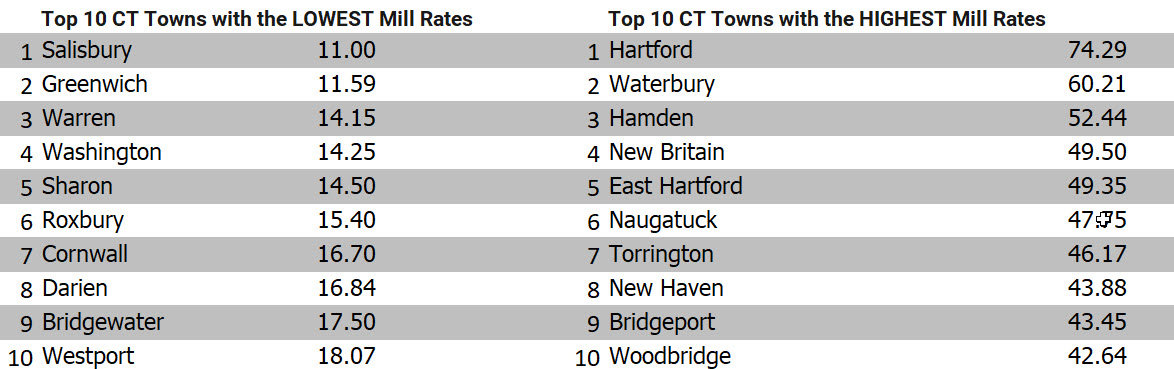

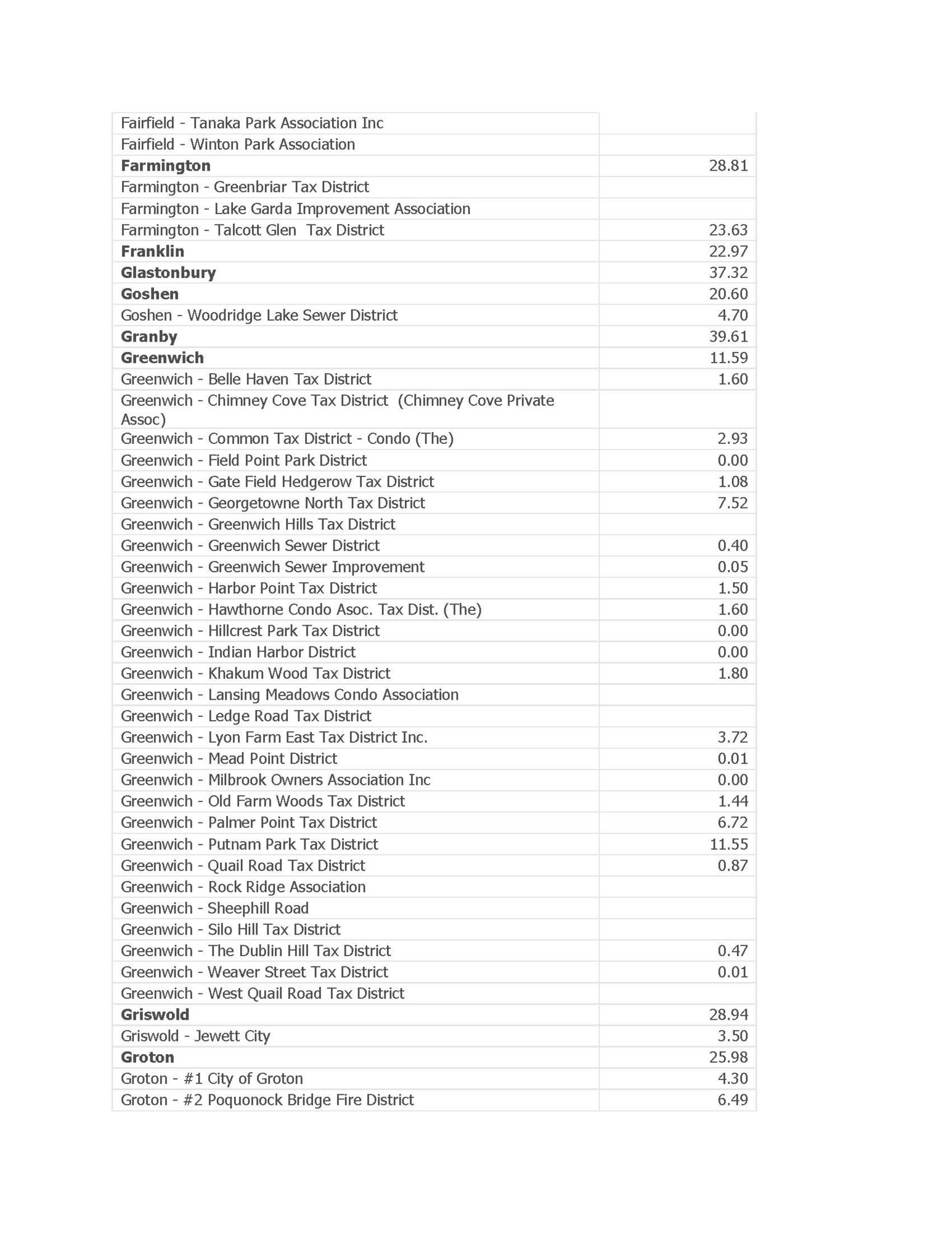

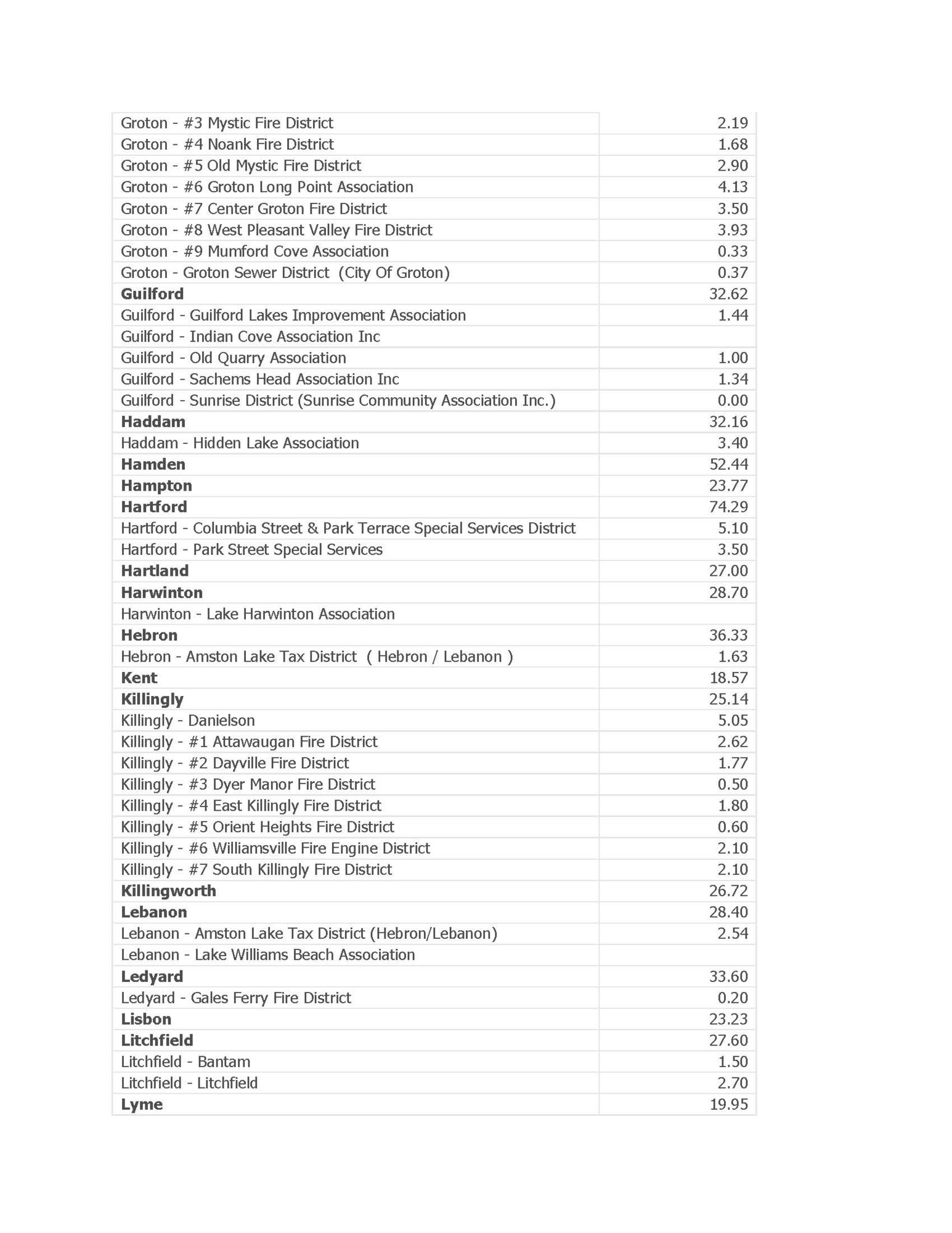

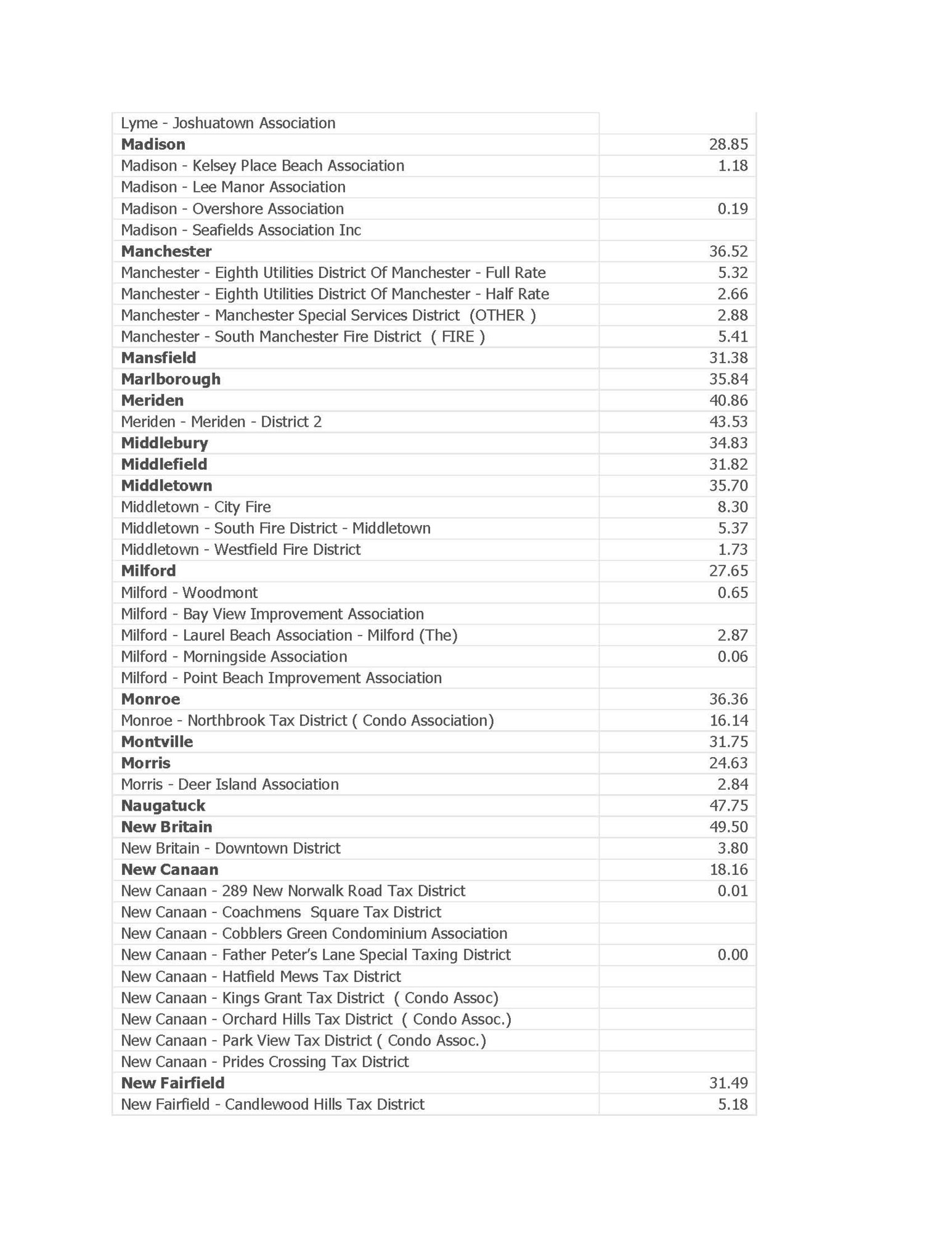

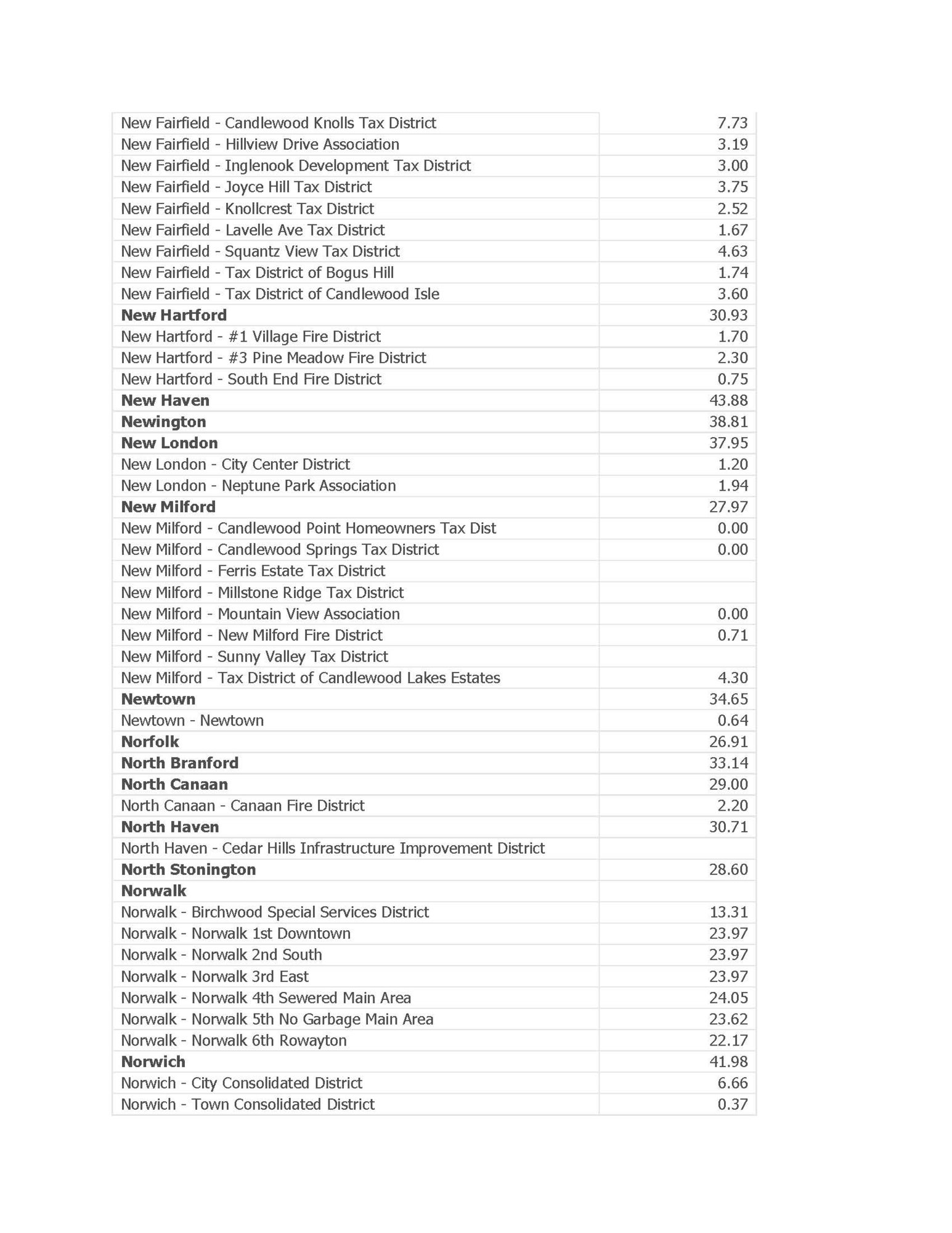

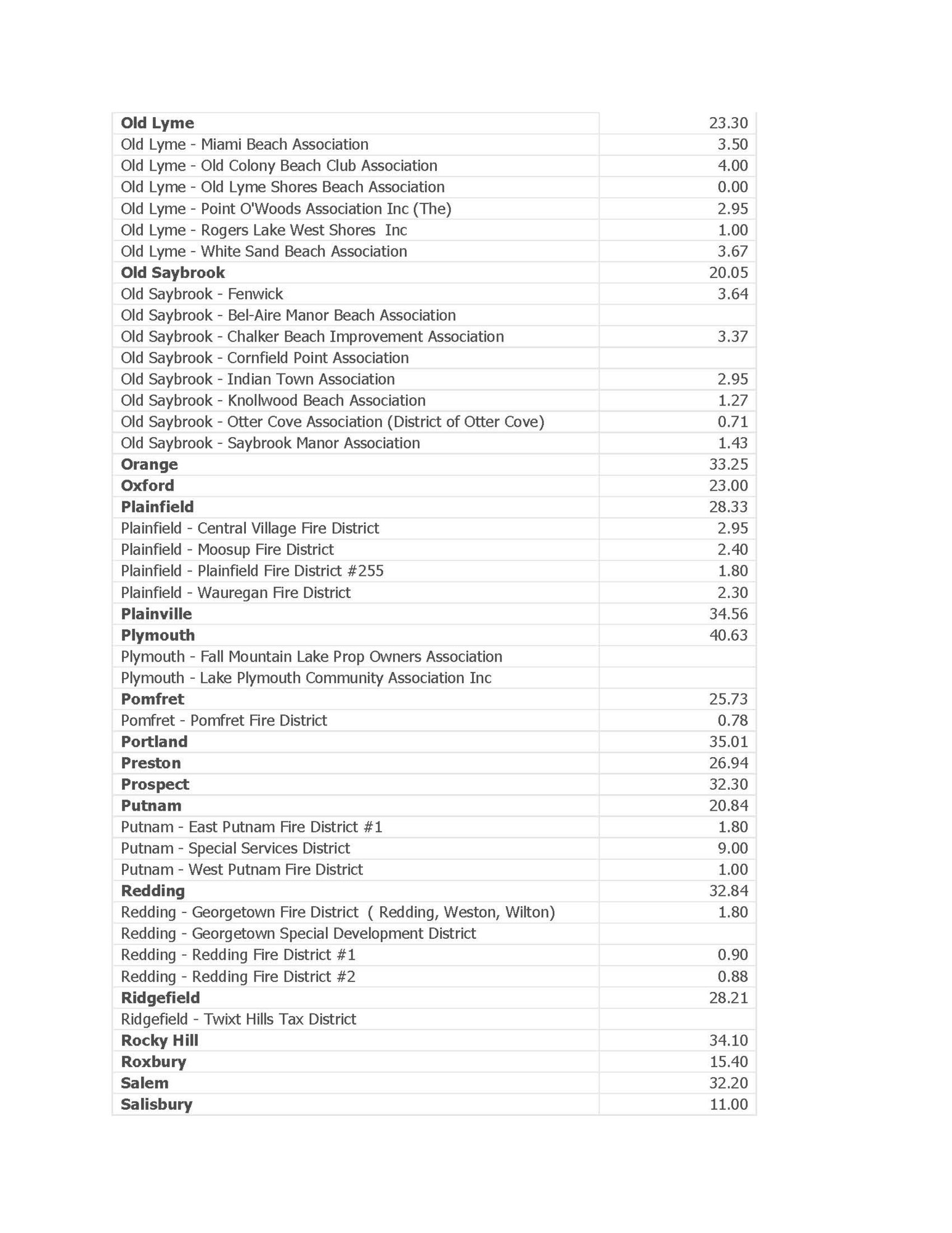

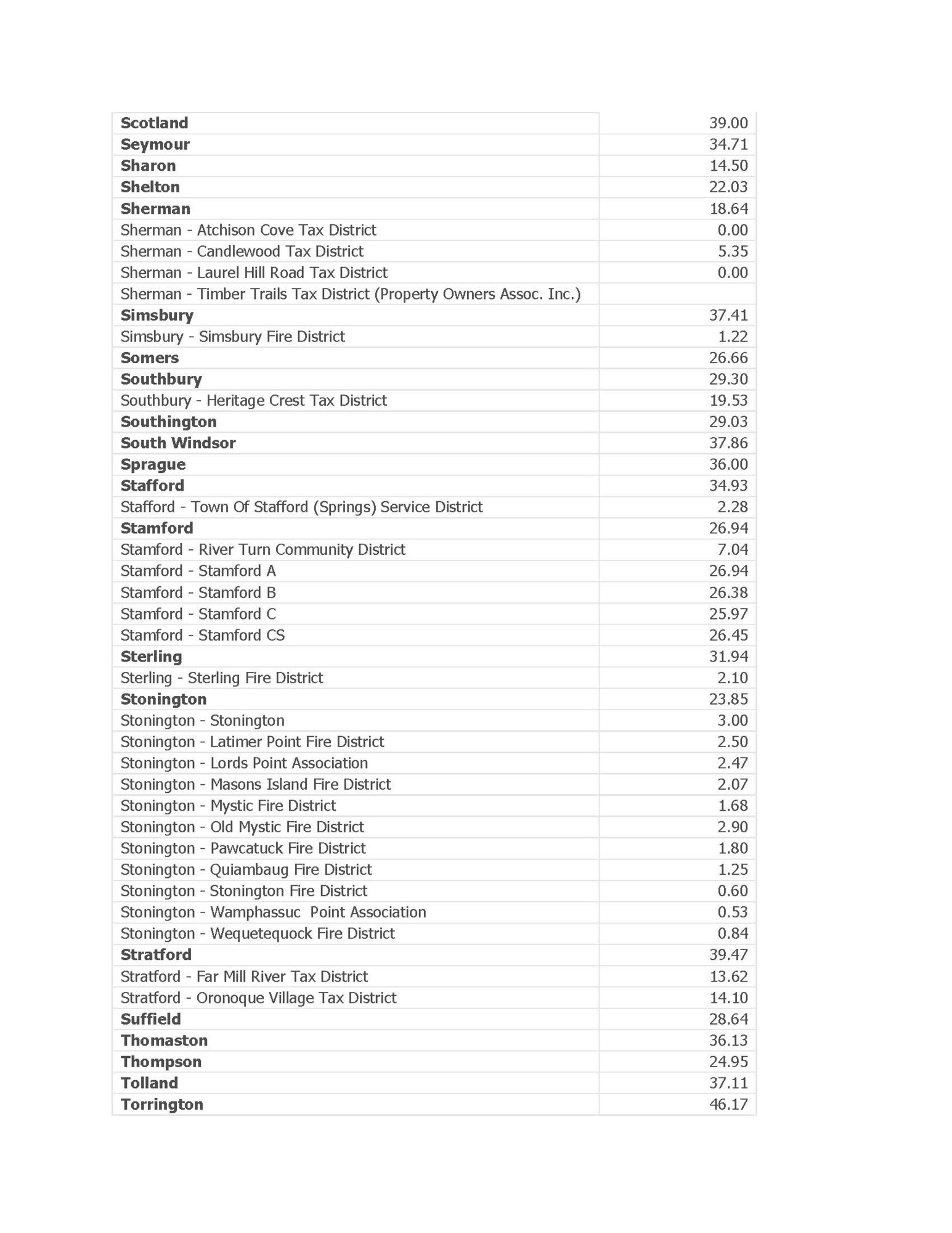

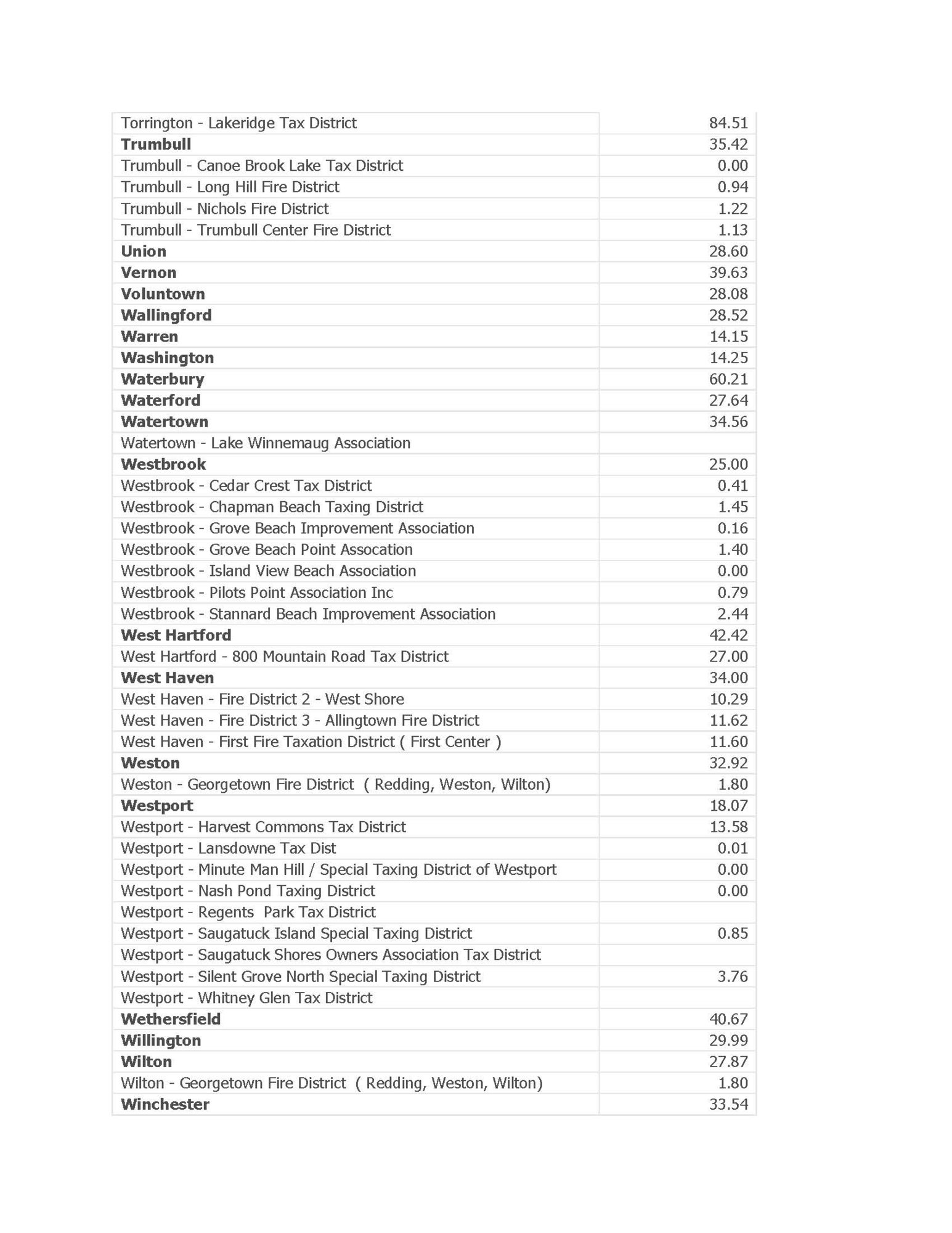

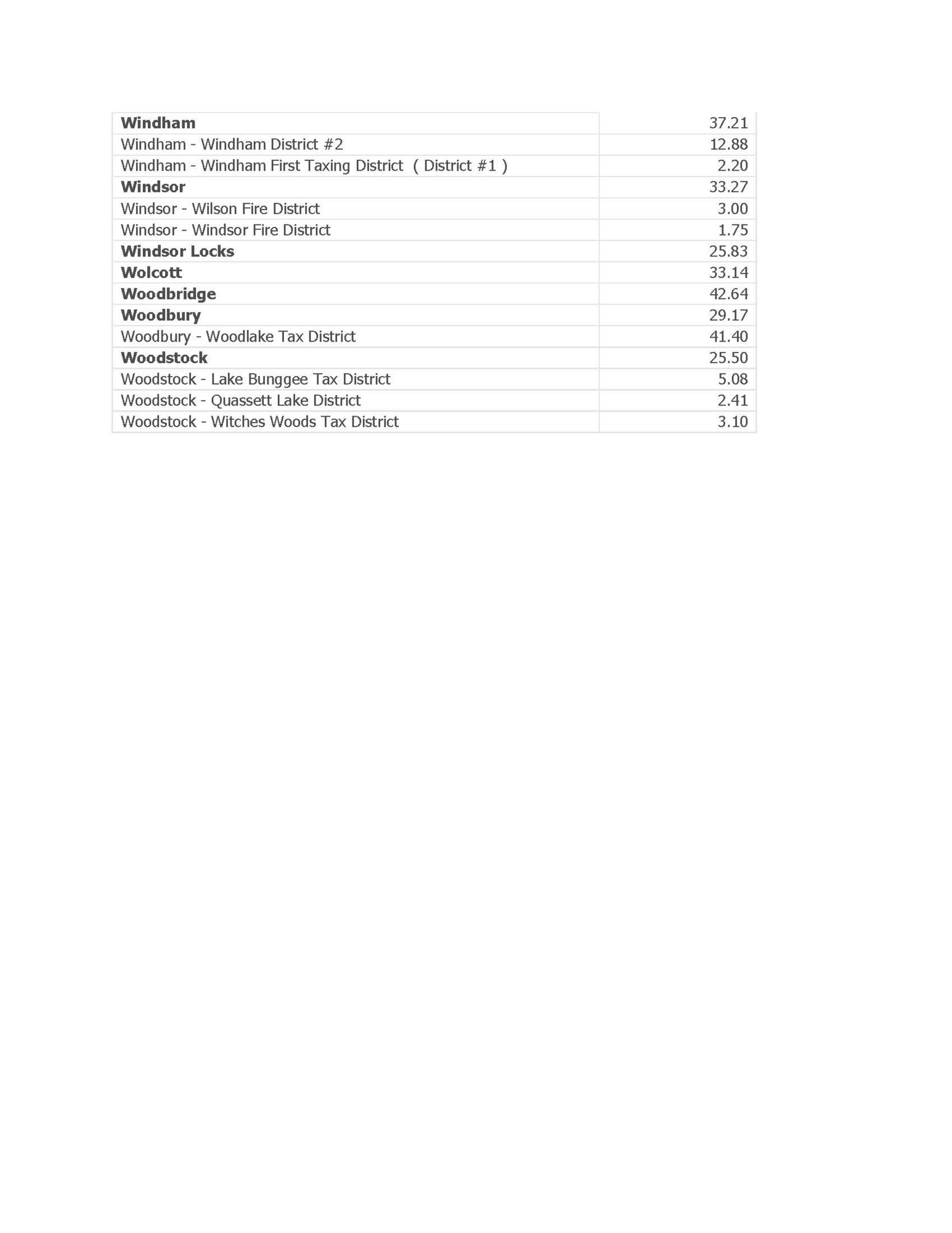

Real Estate Taxes in Connecticut can vary greatly depending on the municipality and districts within them. The graphic above illustrates the base rates for each town. Additional rates are applied to specific locations where services are provided. These services can include public water, sewer, trash removal, police services, or a firehouse. A town or district with a lower Mill rate may not offer these services. Your real estate agent will be able to help you to determine the services offered and their importance to you when purchasing real estate. The average property tax rate in CT for 2022 is $31.29 with the highest being Hartford at $74.29 and the lowest being Salisbury at $11.

How to Calculate Connecticut Property Taxes

The formula to calculate Connecticut Property Taxes is (Assessed Value x Property Tax Rate + any district tax)/1000= Connecticut Property Tax. Take the Assessed Value of the property then multiply it by the Property Tax Rate and then divide it by 1000.

For example, if a home on Masons Islan in the town of Stonington is assessed at $1,000,000. Stonington has a base mill rate of $23.85 and Masons Island has a district tax of $2.07 per every $1,000 of assessed value. The property taxes for the home on Masons Island is $25,920 a year.

($1,000,000 x (23.85+2.07))/1000= $25,920.

How Commercial Properties play a role in the taxes that you pay

The textbook definition of a Mill Rate focuses primarily on the current market value of your home. In appreciating real estate market cycles, when home values increase, your tax bill often follows suit. Obviously, this means your taxes can increase even when the mill rate remains unchanged. It also implies that the amount of taxes you pay is affected only by your home's value. At the same time, your town’s mill rate may be increased even while the assessed amount of your home’s value for tax purposes is in decline. Many times it overlooks exterior market forces and conditions that influence whether your town's Mill Rate and in turn, your taxes, may be increased or decreased.

For example - Towns with a large commercial tax base in the form of occupied Shopping Malls, Restaurants, Retail, Office & Industrial spaces will typically generate a lower Mill Rate that results in a more affordable tax bill for YOU. Pay close attention to those towns, like Waterford, whose tax base was supported by a shopping mall that is in default and on its way out.

By the same token, if you reside in a town that has not created a larger pool of commercial tax revenue, this shortfall may be passed on to you the local homeowner, resulting in higher taxes you are required to pay.

**The exception to this rule would be rural and sparsely populated towns that do not offer services in the form of public water, sewer, and trash removal. Despite a limited commercial tax base, mill rates in these zip codes often remain relatively low.**

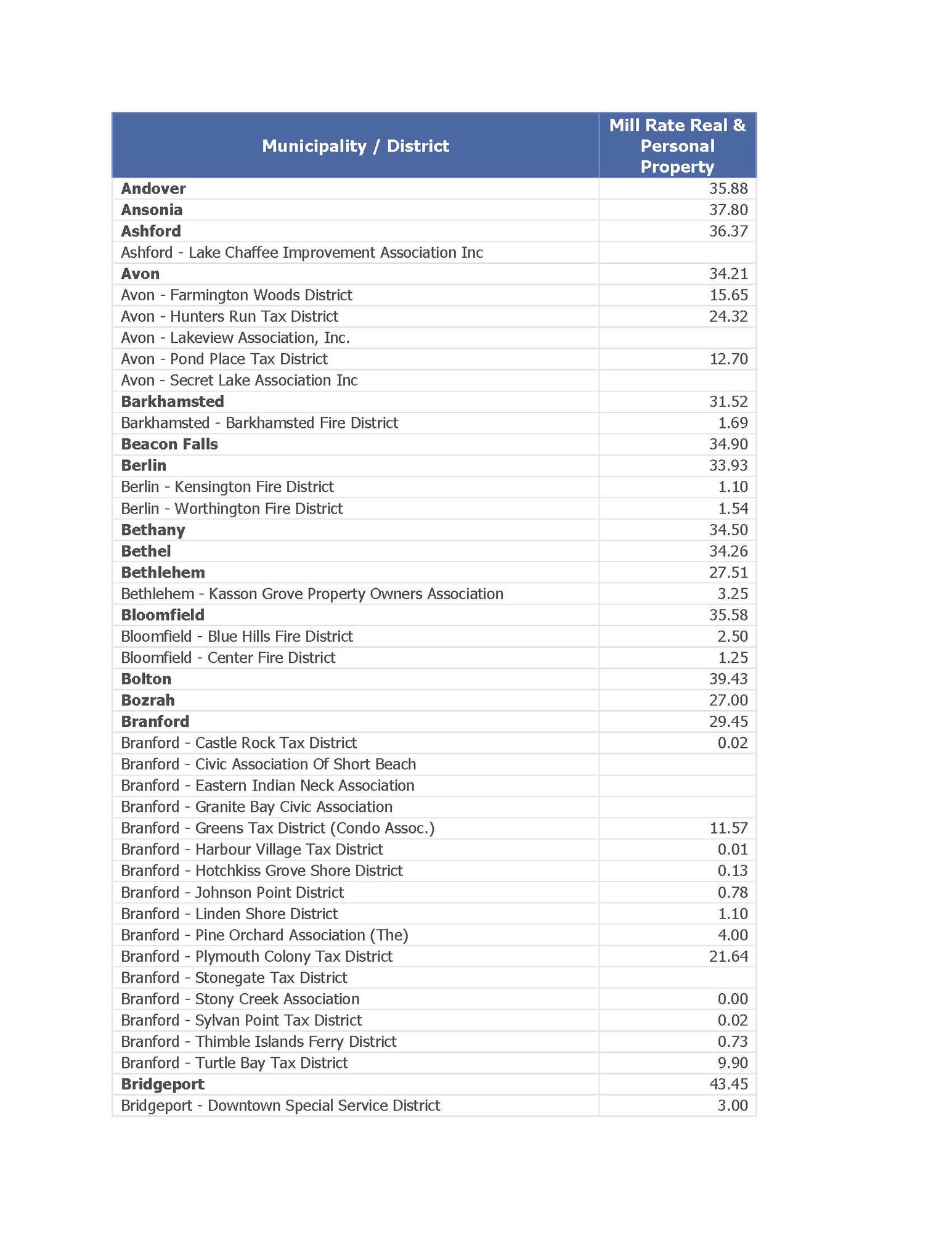

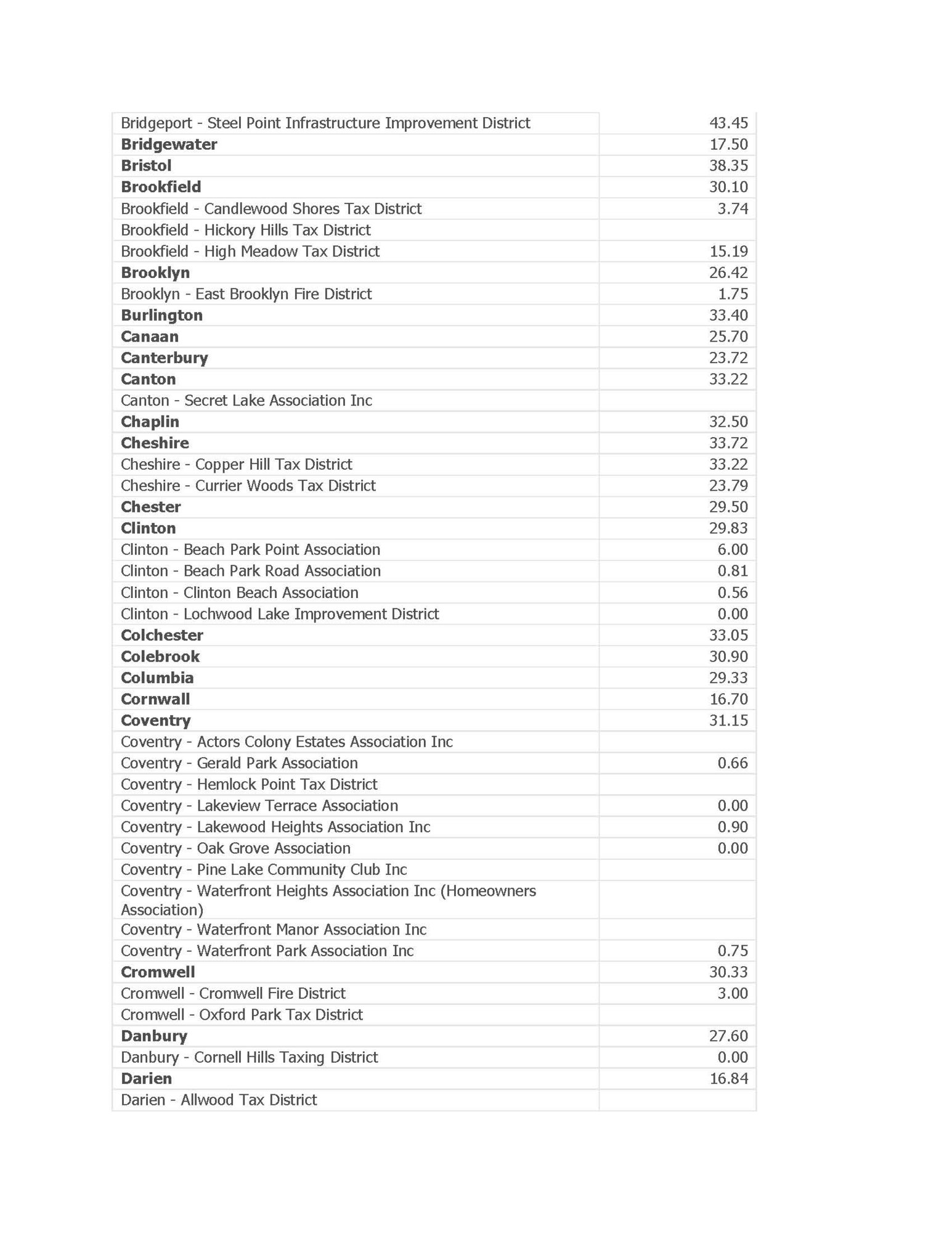

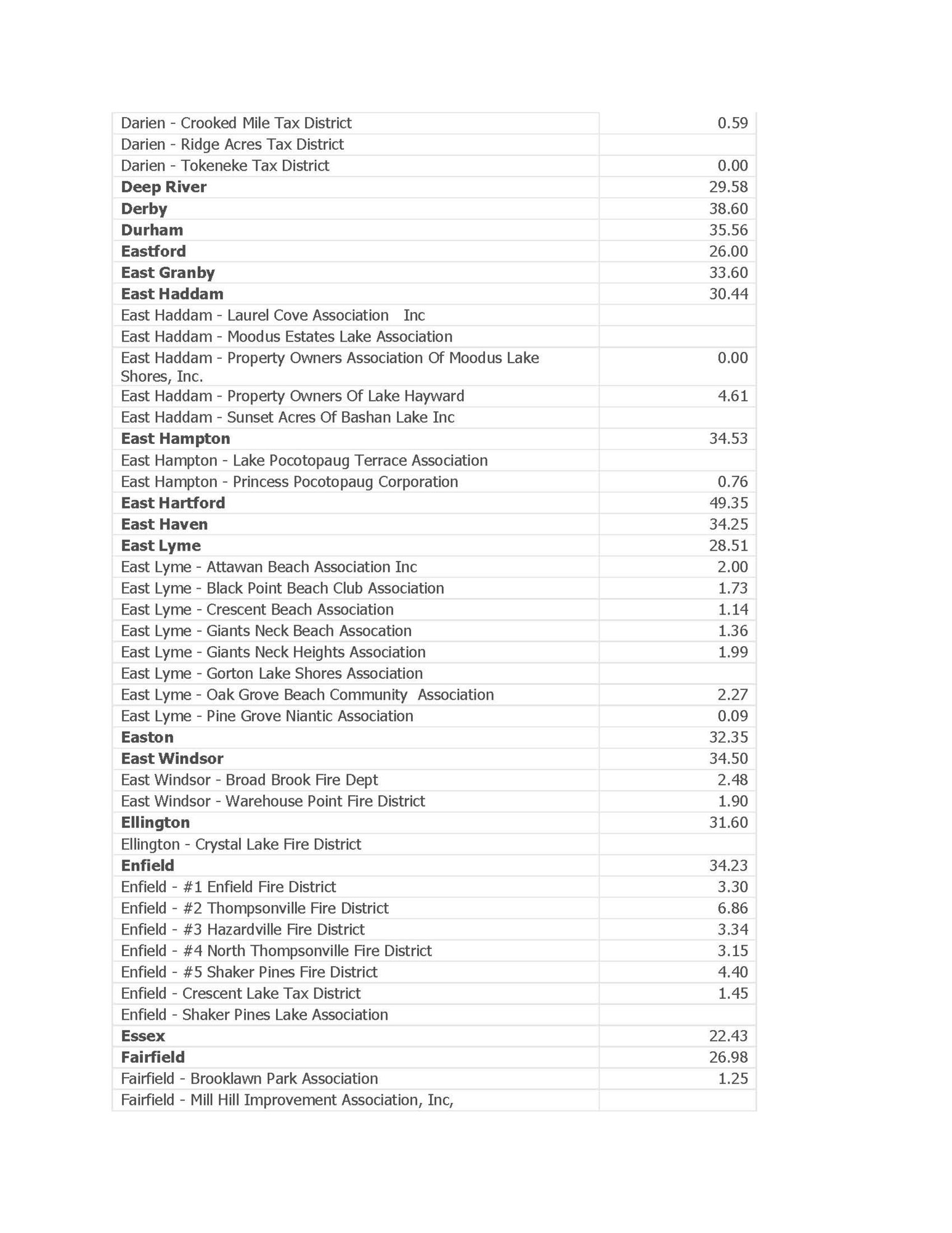

CT Base Mill Rates & Municipal District Rates

Posted by Tim Bray on

Leave A Comment