Navigating the Tides of Change: Housing Affordability in Connecticut's Coastal Towns

Posted by Tim Bray on

In the span of over two decades, Connecticut's coastal towns have painted a picturesque scene of New England charm and scenic waterfronts. However, beneath the surface of these idyllic communities lies a growing concern: the rising tide of housing prices, surging far faster than their residents' incomes.

#ConnecticutCoast #HousingMarket #EconomicTrends

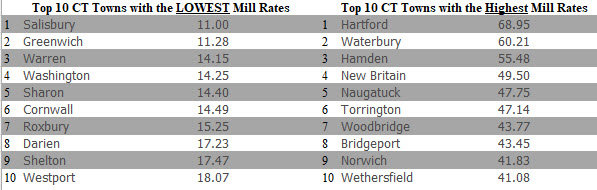

Over the last 23 years, data reveals a trend that could reshape the fabric of towns like Stonington, Darien, and New Haven. While median household incomes have seen modest growth, median selling prices for homes have soared, in some cases, to more than double the income growth percentage.

#AffordableHousing #IncomeGrowth #RealEstateTrends

In Stonington, for example, incomes have risen by…

149 Views, 0 Comments