Major Distress for Commercial Properties Nationally

Posted by Tim Bray on

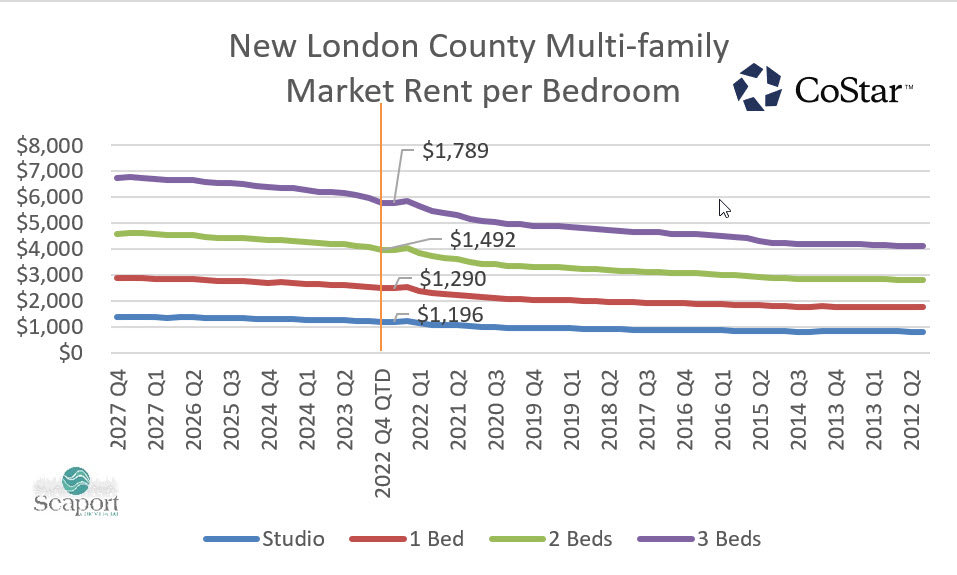

In the world of commercial real estate, the Debt Service Coverage Ratio (DSCR) is a critical metric that plays a pivotal role in the refinancing of properties. A DSCR lower than 1.2 often signals trouble, and recent trends across the country have shown an alarming 602% increase in properties grappling with this issue. However, the impact is not uniform across the board, as we'll see in the case of Connecticut, particularly in New London County.

National Context: Nationally, the picture is stark. In just the last 30 days, properties in distress have skyrocketed from 5,562 to a staggering 33,495, covering about 1.5 billion square feet of space. This surge reflects a significant shift in the commercial property landscape, indicating a broad-scale…

144 Views, 0 Comments